Lecture:

Pune International Centre (PIC) in association with Mahratta Chamber of Commerce Industries & Agriculture (MCCIA) organised a lecture on “Goods and Service Tax (GST) Revolution: Challenges and Opportunities” on 20th June, 2017. The lecture was given by Dr. V. Bhaskar, Former Special Chief Secretary, Finance Govt. of Andhra Pradesh. In the esteemed presence of Dr. Vijay Kelkar, former chairman of the 13th Finance Commission and architect of GST. The programme was chaired by Mr. Pramod Chaudhari Founder Chairman, Praj Industries Ltd., Trustee, PIC and President, MCCIA.

Profile of the speaker:

The main speaker, Dr. V Bhaskar retired from the IAS with international to state level experience on policy formulation and implementation of issues relating to public administration; issues such as finance, taxation, and energy regulation.

In the varies duties that he has performed in the past, he has been the Chairman, Andhra Pradesh Electricity Regulatory Commission and Special Chief Secretary in the Finance Department of the Government of Andhra Pradesh. He has also worked in the International Monetary Fund at Washington DC, in the Ministry of Finance and Ministry of Commerce and Industry for Government of India at New Delhi. He has also played an instrumental role in the Thirteenth Finance Commission which suggested the GST reform in first place. He has also worked as Collector and District Magistrate of Anantapur and Visakhapatnam districts in Andhra Pradesh. Prior to joining the IAS, he worked in the management cadre of the State Bank of India, specializing in credit to industries.

Dr. V. Bhaskar obtained his Masters in Public Administration from Harvard University and Masters in Science from St Stephen’s College, Delhi followed by which he also secured a PhD in Economics from the University of Hyderabad. He is also a Certificated Associate of the Indian Institute of Bankers, Mumbai. During and post his academic tenure he has published a number of research papers on the topics of his professional interests which include taxation, public finance, governance and energy regulations.

Dr. Bhaskar provided insightful explanations on the need, operations and tricky parts of GST. This report is a collated version of the entire talk.

What is GST?

Goods & Services Tax is a comprehensive, multi-stage, destination-based tax that will be levied on every value addition.

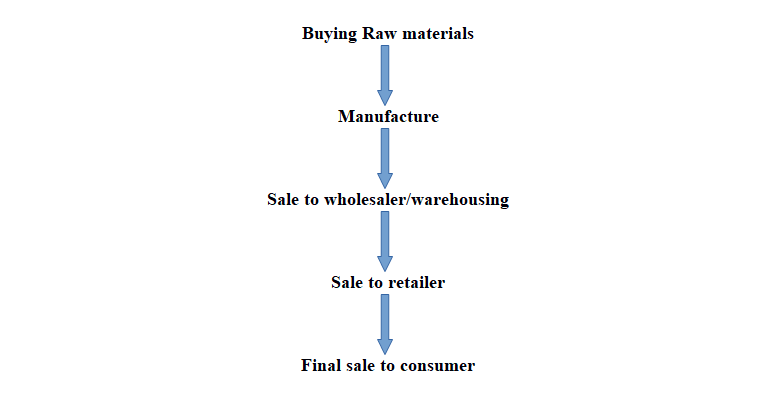

There are multiple steps an item goes through from manufacture or production to the final sale, these can be called as multiple stages. Buying of raw materials is the first stage. The second stage is production or manufacture. Then, there is the warehousing of materials. Next, comes the sale of the product to the retailer. And in the final stage, the retailer sells you – the end consumer – the product, completing its life cycle.

The various stages of the life cycle would be like this:

GST will be levied on each of these stages, which makes it a multi-stage tax on value addition. Value addition can be explained using an example.

GST will be levied on each of these stages, which makes it a multi-stage tax on value addition. Value addition can be explained using an example.

Let us assume that a manufacturer wants to make a shirt. For this he must buy yarn. This gets turned into a shirt after manufacture. So, the value of the yarn is increased when it gets woven into a shirt. Then, the manufacturer sells it to the warehousing agent who attaches labels and tags to each shirt. That is another addition of value after which the warehouse sells it to the retailer who packages each shirt separately and invests in marketing of the shirt thus increasing its value. GST will be levied on these value additions – the monetary worth added at each stage to achieve the final sale to the end customer.

Destination-Based Taxation:

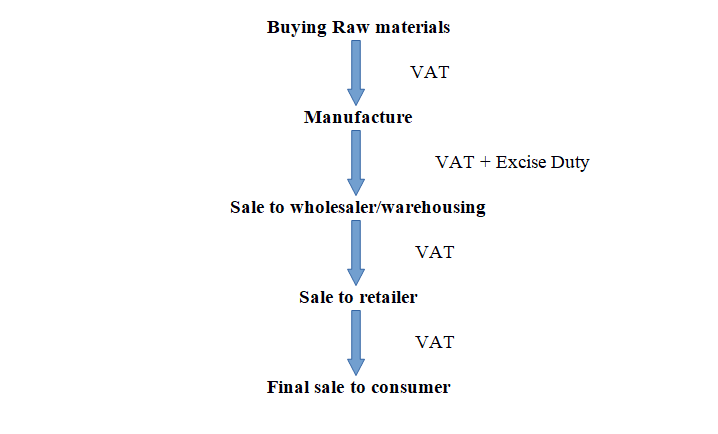

Goods and Services Tax will be levied on all transactions happening during the entire manufacturing chain. Earlier, when a product was manufactured, the centre would levy an Excise Duty on the manufacture, and then the state will add a VAT tax when the item is sold to the next stage in the cycle. Then there would be a VAT at the next point of sale.

So, earlier the pattern of tax levy was like this:

Now, Goods and Services Tax will be levied at every point of sale. Assume that the entire manufacture process is happening in Rajasthan and the final point of sale is in Karnataka. Since Goods & Services Tax is levied at the point of consumption, so the state of Rajasthan will get revenue in the manufacturing and warehousing stages, but lose out on the revenue when the product moves out Rajasthan and reaches the end consumer in Karnataka. This means that Karnataka will earn that revenue on the final sale, because it is a destination-based tax and this revenue will be collected at the final point of sale/destination which is Karnataka.

Now, Goods and Services Tax will be levied at every point of sale. Assume that the entire manufacture process is happening in Rajasthan and the final point of sale is in Karnataka. Since Goods & Services Tax is levied at the point of consumption, so the state of Rajasthan will get revenue in the manufacturing and warehousing stages, but lose out on the revenue when the product moves out Rajasthan and reaches the end consumer in Karnataka. This means that Karnataka will earn that revenue on the final sale, because it is a destination-based tax and this revenue will be collected at the final point of sale/destination which is Karnataka.

Need of GST:

A significant chunk of Dr. Bhaskar’s talk focused on the need of a unified taxation through the country because of the overly complicated pre existing structure of the taxation. As briefly discussed above currently, the Indian tax structure is divided into two – Direct and Indirect Taxes. Direct Taxes are levies where the liability cannot be passed on to someone else. An example of this is Income Tax where you earn the income and you alone are liable to pay the tax on it.

In the case of Indirect Taxes, the liability of the tax can be passed on to someone else. This means that when the shopkeeper must pay VAT on his sale, he can pass on the liability to the customer. So, in effect, the customer pays the price of the item as well as the VAT on it so the shopkeeper can deposit the VAT to the government. This means that the customer must pay not just the price of the product, but he also pays the tax liability, and therefore, he has a higher outlay when he buys an item.

This happens because the shopkeeper has paid a tax when he bought the item from the wholesaler. To recover that amount, as well as to make up for the VAT he must pay to the government, he passes the liability to the customer who has to pay the additional amount. There is currently no other way for the shopkeeper to recover whatever he pays from his own pocket during transactions and therefore, he has no choice but to pass on the liability to the customer.

Goods and Services Tax will address this issue after it is implemented. It has a system of Input Tax Credit which will allow sellers to claim the tax already paid, so that the final liability on the end consumer is decreased. Input Tax Credit is a credit an individual receives for the tax paid on the inputs used in manufacturing the product. So, if there is a 10% tax that the individual must submit to the government, he can subtract the amount he has paid in taxes at the time of purchase and submit the balance amount to the government.

The GST being unification of various taxes is another strong advantage that this new taxation system offers the Indian market. Prior to GST, Indian markets dealt with around 46 different types of taxes. Ideally this number should be in single digit, GST has done a substantial work in getting it down to 22 in one swooping act.

Working of GST:

So essentially, Goods & Services Tax is going to have a two-pronged benefit. One, it will reduce the cascading effect of taxes, and second, by allowing input tax credit reducing the burden of taxes and prices as seen above.

When Goods and Services Tax is implemented, there will be 3 kinds of applicable Goods and Services Taxes:

CGST: where the revenue will be collected by the central government

SGST: where the revenue will be collected by the state governments for intra-state sales

IGST: where the revenue will be collected by the central government for inter-state sales

In most cases, the tax structure under the new regime will be as follows:

Example:

A dealer in Maharashtra sold goods to a consumer in Maharashtra worth ₹ 10,000. The Goods and Services Tax rate is 18% comprising CGST rate of 9% and SGST rate of 9%. In such cases the dealer collects ₹ 1800 and of this amount, ₹ 900 will go to the central government and ₹ 900 will go to the Maharashtra government.

Now, let us assume the dealer in Maharashtra had sold goods to a dealer in Gujarat worth ₹ 10,000. The GST rate is 18% comprising of CGST rate of 9% and SGST rate of 9%. In such case the dealer has to charge ₹ 1800 as IGST. This IGST will go to the Centre. There will no longer be any need to pay CGST and SGST as the dealer will get a credit in his name against this IGST which can be later claimed by the dealer while filing the suitable tax returns.

How does GST benefit the common man:

Let us understand this with a hypothetical numerical example:

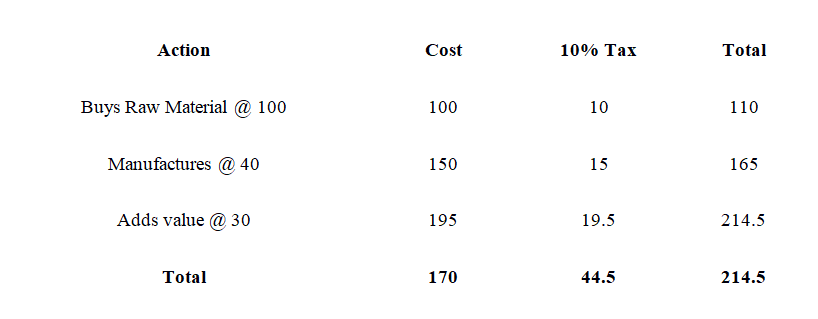

Say a shirt manufacturer pays ₹ 100 to buy raw materials. If the rate of taxes is set at 10%, and there is no profit or loss involved, then he has to pay ₹ 10 as tax. So, the final cost of the shirt now becomes ₹ (100+10=) 110.

At the next stage, the wholesaler buys the shirt from the manufacturer at ₹ 110, and adds labels to it. When he is adding labels, he is adding value. Therefore, his cost increases by say ₹ 40. On top of this, he has to pay a 10% tax, and the final cost therefore becomes ₹ (110+40=) 150 + 10% tax = ₹ 165.

Now, the retailer pays ₹ 165 to buy the shirt from the wholesaler because the tax liability had passed on to him. He has to package the shirt, and when he does that, he is adding value again. This time, let’s say his value add is ₹ 30. Now when he sells the shirt, he adds this value (plus the VAT he has to pay the government) to the final cost. So, the cost of the shirt becomes ₹ 214.5 Let us see a breakup for this:

Cost = ₹ 165 + Value add = ₹ 30 + 10% tax = ₹ 195 + ₹ 19.5 = ₹ 214.5

So, the customer pays ₹ 214.5 for a shirt the cost price of which was basically only ₹ 170 (Rs 110 + ₹ 40 + ₹ 30). Along the way the tax liability was passed on at every stage of transaction and the final liability comes to rest with the customer. This is called the ‘Cascading Effect of Taxes’ where a tax is paid on tax and the value of the item keeps increasing every time this happens.

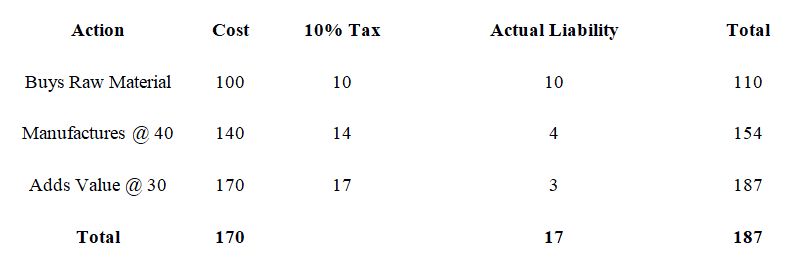

In the case of Goods and Services Tax, there is a way to claim credit for tax paid in acquiring input. What happens in this case is, the individual who has paid a tax already can claim credit for this tax when he submits his taxes.

In our example, when the wholesaler buys from the manufacturer, he pays a 10% tax on his cost price because the liability has been passed on to him. Then he adds value of ₹ 40 on his cost price of ₹ 100 and this brings up his cost to ₹ 140. Now he has to pay 10% of this price to the government as tax. But he has already paid one tax to the manufacturer. So, this time what he does is, instead of paying Rs (10% of 140=) 14 to the government as tax, he subtracts the amount he has paid already. So, he deducts the ₹ 10 he paid on his purchase from his new liability of ₹ 14, and pays only ₹ 4 to the government. So, the ₹ 10 becomes his input credit.

When he pays ₹ 4 to the government, he can pass on its liability to the retailer. So, the retailer pays ₹ (140+14=) 154 to him to buy the shirt. At the next stage, the retailer adds value of ₹ 30 to his cost price and has to pay a 10% tax on it to the government. When he adds value, his price becomes ₹ 170. Now, if he had to pay 10% tax on it, he would pass on the liability to the customer. But he already has input credit because he has paid ₹14 to the wholesaler as the latter’s tax. So, now he reduces ₹ 14 from his tax liability of ₹ (10% of 170=) 17 and has to pay only ₹ 3 to the government. And therefore, he can now sell the shirt for ₹ (140+30+17) 187 to the customer.

In the end, every time an individual was able to claim input tax credit, the sale price for him reduced and the cost price for the person buying his product reduced because of a lower tax liability. The final value of the shirt also therefore reduced from ₹ 214.5 to ₹ 187, thus reducing the tax burden on the final customer.

In addition to the change in the pricing, GST improves the implementation of taxation stages. Now, taxation is applied in 4 main stages including:

- Levy

- Collection

- Appropriation

- Apportion

In the previous taxation scheme, different governmental bodies were performing different roles with different types of taxes without much consistency across nation. With GST reform, there is a clear cut mandate of which agencies to take care of the respective stages of the taxation process, this will cause a much harmonies procedure leading to a very efficient management of taxation funds by the government in most coherent fashion.

Overview of GST:

GST is being implemented by the government with a clear cut purpose to achieve the following:

- Ease of doing business in India

- Promote investments (external and internal)

- Give rise to competitive business culture

- Harmonise the national marketing

- Cause a catalyst to the growth of India

- Provide a unified taxation platform for services and goods likewise